Climate compensation 2019-2020, marked by pandemic and climate change

November 2, 2020

Every year since 2006, Forest Trends Ecosystem Marketplace, through its globally recognized survey, has tracked trends in the voluntary offset market. The report is based on studies and surveys with representatives from the carbon offset market. This is a summary and translation of the latest Ecosystem Marketplace report, "Voluntary Carbon and the Post-Pandemic Recovery".

Big increase in 2019

Companies all over the world are taking steps to eliminate greenhouse gas emissions from their operations. However, most find that it is either technically impossible to eliminate all emissions directly, or that the costs of doing so are too high. To deliver reductions in a cost-effective and timely manner, many companies have pledged to become climate neutral in the short term by financing emission reductions in carbon offset projects. This has resulted in record volumes of offsets sold, despite the global COVID-19 pandemic.

1.

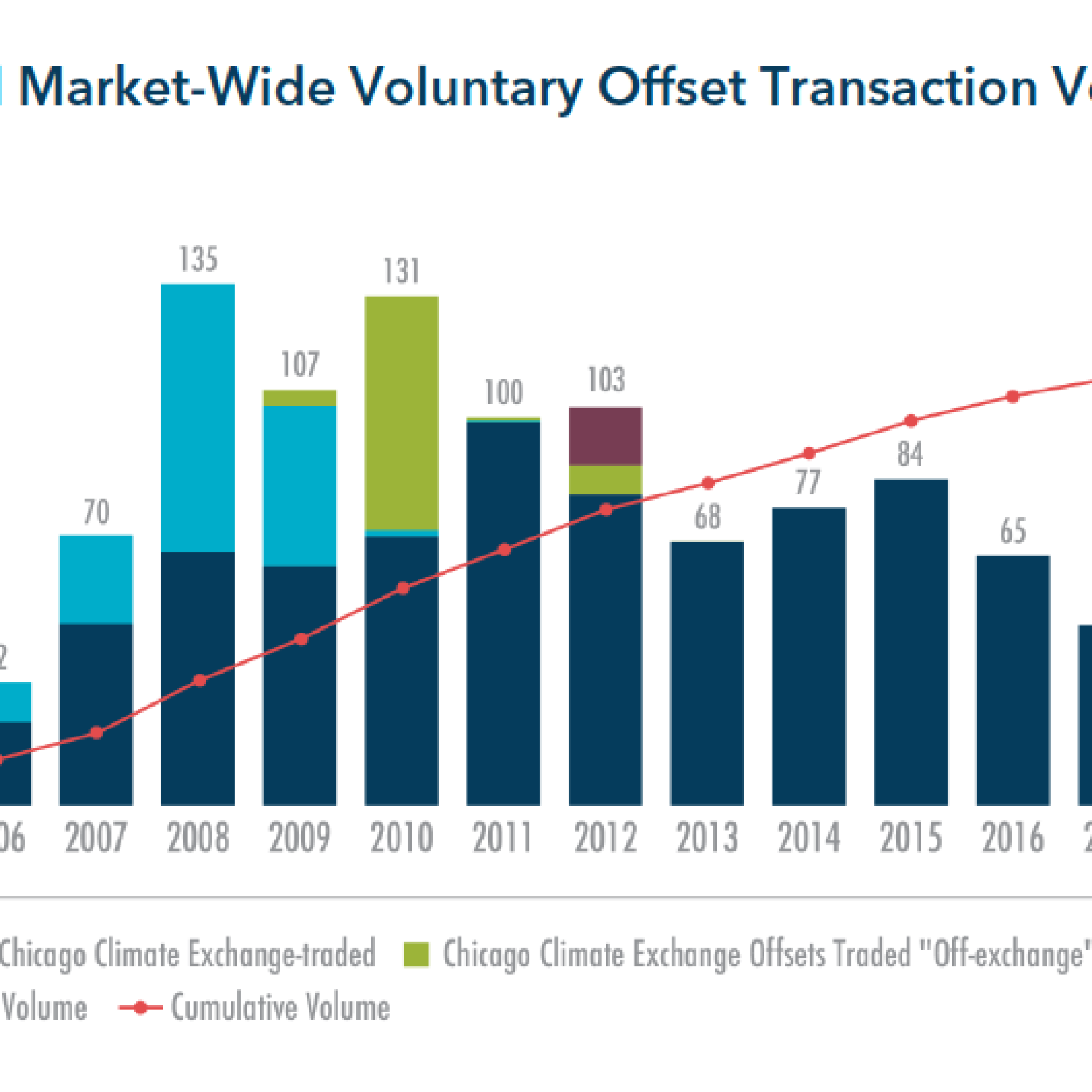

Pledges to reach climate neutrality yielded a record volume of at least 104 MtCO2e (million tons of carbon dioxide equivalent) in 2019, a 6% increase compared to 2018.

2.

Volume has been surprisingly strong and consistent in 2020, despite the pandemic. Interviews with market participants suggest that it may even exceed 2019. Broader strategies have compensated for the loss of volume from the travel sector.

3.

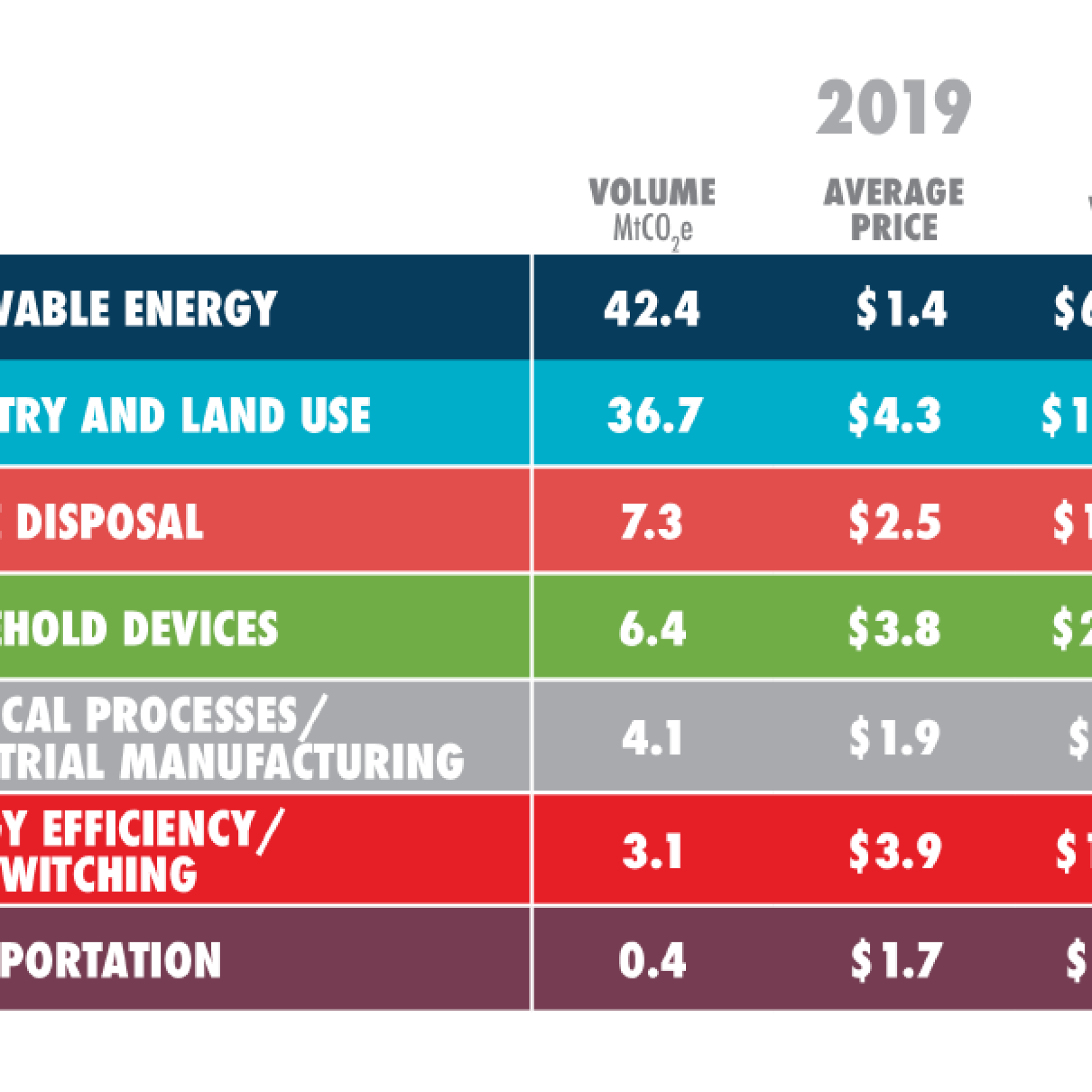

Average prices for offsets remained unchanged in 2019, but with large variations by type. Prices for offsets based on natural climate solutions (AFOLU - agriculture, forestry and other land use projects) increased by 30%, while prices for renewable energy projects decreased by 16%.

4.

Price and volume moved in opposite directions for these different types of offsets. The volume of credits from tree projects, forestry and sustainable land use decreased by 28%, and the amount of credits from energy projects increased by 78%.

5.

Despite the lower volume, the market value of AFOLU projects was more than double that of renewable energy.

Average price of different types of carbon offset credits in 2019.

Increase despite Covid-19

By the end of March and early April, COVID-19 had spread across the world and greenhouse gas emissions were falling. This was of course due to the global economy coming to a standstill, rather than because of successful strategies to reduce emissions. There was widespread fear that these would quickly go up as the economy recovered, and that voluntary climate pledges by companies would likely be put on hold. Now we can see that while emissions have rebounded from the low levels seen last spring, companies have not given up on their climate pledges - quite the opposite. The number of companies that say they are striving for climate neutrality, and thus buying carbon offsets, has never been higher. Interest in carbon offsetting has also increased since the Science Based Targets Initiative updated its guidance, stating that carbon offsetting should be part of helping companies reduce their climate impact.

Fear in the debate

There has long been a widespread fear that companies will use offsetting as an excuse not to reduce emissions internally, and this debate continues this year. However, research shows that many large companies are using voluntary offsetting as part of a broader strategy. Previous market research has also shown that companies that put a price on carbon tend to be the most aggressive in reducing emissions internally. They use carbon offsetting as a way to accelerate reductions.

Price and volume

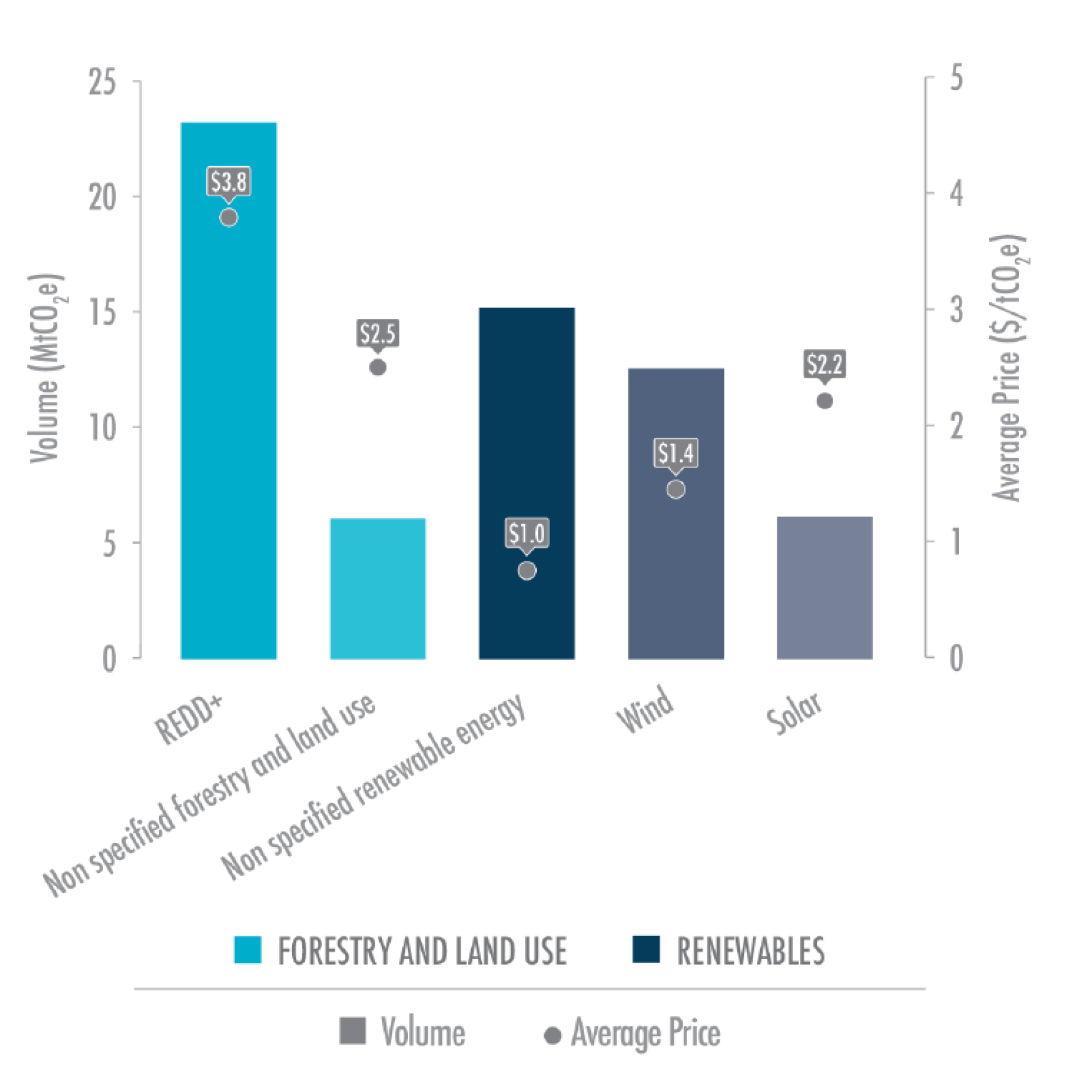

In 2019, the number of credits generated from energy projects increased by 78%, while the price decreased by 16% compared to the previous year. The volume of credits from AFOLU projects decreased by 30%. Of the AFOLU projects sold, REDD+ is the largest category. Although renewable energy as a category dominated transactions in volume, REDD+ is the most popular project type across all categories by a wide margin, in terms of the number of projects available of that type.

REDD+ projects often deliver so-called 'co-benefits' to the people involved in the projects locally, for example by creating local jobs or contributing to the UN Sustainable Development Goals in other ways. Because of these added values, AFOLU projects are often priced higher than renewable energy projects.

REDD+ projects deliver the largest amount of credits.

Renewable energy on the decline

The voluntary carbon offset market has historically been used to finance the development of renewable energy projects. In many cases, these technologies could not have been implemented without the additional support provided by carbon offset funding. However, this is changing as renewable energy technologies are generally becoming cheaper. This means that carbon finance is only needed to implement certain types of projects in certain countries. As a result, we see that some energy projects will eventually be phased out.

Several of the market participants surveyed for this report suggest that demand for credits from energy projects in general may come from companies that are new to the carbon offset market. New buyers tend to focus more on finding cheap credits instead of quality projects. Previous reports from the voluntary offset market have shown that the same companies have been buying offsets for a long time, and that new large buyers entered the market on a large scale in 2018. It is of course positive that more people are buying offsets, but only if the buyers use offsets that contribute to actual emission reductions.

Transactions of carbon offset credits have increased since 2005.

Emission reductions essential to prevent disaster

Recently published research on 2019 emissions shows that even if all countries meet their current climate action targets, greenhouse gas emissions will be a staggering 32 billion tons higher in 2030 than they must be to meet the Paris Agreement's 1.5-degree target. Therefore, to meet the target, both countries and businesses need to focus on both reducing their greenhouse gas emissions and offsetting emissions that they cannot eliminate. The focus must also be on actively supporting activities that remove carbon from the atmosphere.

Controversial issue

The issue of accounting for voluntary offsets carried out in one country but purchased in another is still a contentious issue that has been delayed due to the suspension of climate negotiations as a result of the pandemic. The Paris Agreement requires all countries to account for their emissions and states that emission reductions transferred internationally must be recorded as a correction to the national inventories of both countries involved in the transaction. How this will work in practice is not yet resolved and countries are divided on how a solution should be designed. Some argue that it is inappropriate to call internationally transferred reductions offsets unless there is a corresponding adjustment to the emissions in the registries of both countries involved, while others argue that such an adjustment is unnecessary in voluntary markets as long as the unit is transferred.

About Ecosystem Marketplace

The Ecosystem Marketplace, launched by the non-profit organization Forest Trends, is a globally recognized source of information on environmental finance, payments for ecosystem services and the carbon offset market. Forest Trends works to create finance for ecosystem conservation, with a special focus on forests.

Learn about the post-pandemic sustainable trends with our seminar series here.